Fixed Deposit calculators serve as integral gear for individuals navigating the intricacies of FD investments, especially whilst handling compound interest. They calculate FD interest, offering a simplified solution to what can often be complex calculations, presenting customers with a trouble-free method of figuring out the potential returns on their investments.

While FDs offer a secure avenue for saving and investing, the allure of compound interest can sometimes be overshadowed by the complexities of its computation. However, FD calculators alleviate this burden by streamlining the process and offering correct insights into investments’ growth over the years.

Why is using an FD calculator beneficial?

Using an FD calculator gives numerous benefits, particularly for making planned investments in FDs:

-

Effortless Calculations

FD calculators eliminate the need for manual calculations. They handle complex interest computations, ensuring accuracy and saving time.

-

Informed Decisions

With an FD calculator, you could experiment with extraordinary situations. Try out numerous investment quantities, FD interest rate prices, and tenures to study how they impact the very last maturity price. This enables you to make informed choices that approximate your FD funding.

-

Comparison Tool

Irrespective of where you are considering FDs from, an FD calculator lets you examine the offerings judiciously. Simply enter the info for every FD scheme (investment amount, interest charge, tenure) and see which yields the best returns.

-

Financial Planning

Knowing the maturity amount beforehand empowers you to plan your budget successfully. You can issue the expected FD returns to fulfil your future monetary goals.

Overall, FD calculators are user-pleasant equipment that streamline the FD funding process, making it simpler to understand returns and evaluate alternatives.

What are the different FD interest calculation methods?

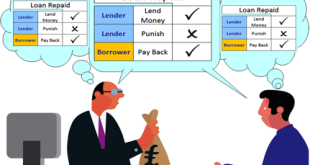

Choosing between these methods depends on the FD’s tenure. For short-term FDs, the difference between simple and compound interest is negligible, but compound interest can significantly boost overall returns for longer tenures.

Pros and Cons of different FD interest rate calculation methods

PROS

-

Higher returns

This technique is the clear winner, providing appreciably higher returns than easy hobbies. The longer the tenure, the greater the advantage of compounding.

-

Exponential increase

Your profits grow exponentially as you earn a hobby on each primary quantity and the amassed hobby from previous periods. This snowball impact results in a sizable boom in your final adulthood quantity.

CONS

-

Lower earnings

Compared to compound interest, SI gives drastically lower returns, especially for longer tenures. You need to take advantage of the potential for exponential growth.

-

Limited growth capability

Since interest is simplest earned at the most important amount, your income remains stagnant over the years.

Which is the best app for investing in Fixed Deposits?

When considering where to invest money on Fixed Deposits (FDs), the significance of competitive rates and person-pleasant systems cannot be overstated. Bajaj Finserv has always been my choice as it stands out in the marketplace. The FD interest rate they offer is competitive and effortless, as they have a seamless online platform. This platform removes the need to go to bodily branches, presenting buyers with convenience and time-saving advantages.

Moreover, Bajaj Finserv offers flexibility in FD tenure and payout alternatives, making sure that investors can tailor their investments to satisfy their specific wishes. Additionally, the brand’s stable popularity in India adds a layer of trust and peace of mind for individuals searching for reliability in their monetary endeavors.

Summing up

In essence, compound interest is the most convenient real method used for FD calculations via most banks and monetary establishments.

Simple interest is probably utilized in theoretical examples for evaluation functions, but it wouldn’t be a sensible option for FD investments due to the appreciably decreased returns. Also, with the availability of an FD calculator online, it has now become even more convenient!